- By TOP CHINA FREIGHT

- August 5, 2025

- Term

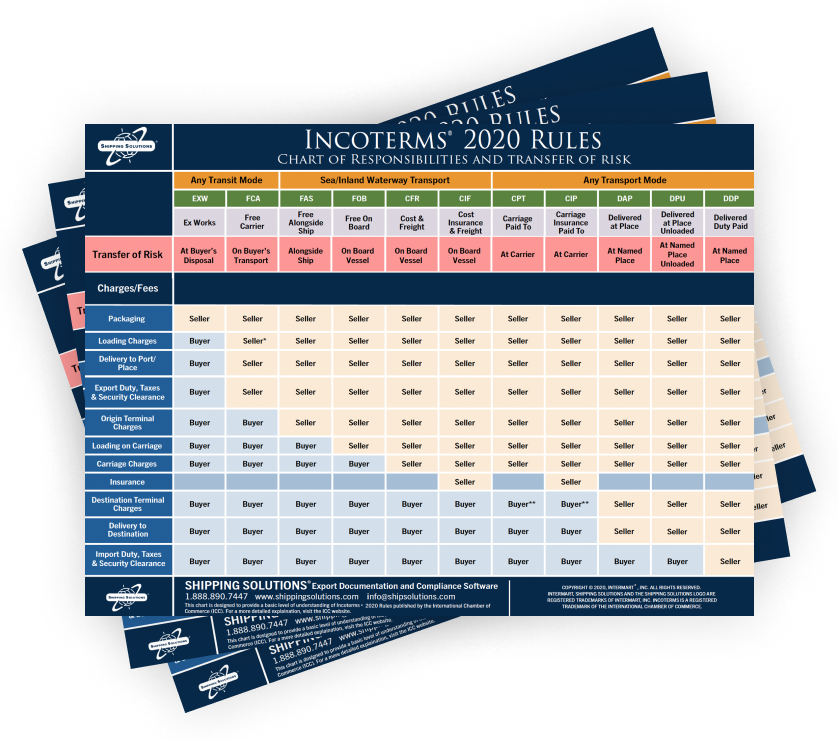

When dealing with international trade, understanding Incoterms is essential for avoiding confusion, reducing risk, and saving money. Whether you’re an importer, exporter, or freight forwarder, getting a grip on how Incoterms work—and how to read an Incoterms chart—can transform your global shipping operations.In this guide, we’ll explain what Incoterms are, break down the most used terms, and show you how to read an Incoterms chart for faster, smarter shipping decisions.

1.What Are Incoterms?

Incoterms, short for International Commercial Terms, are a set of rules published by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers in global trade transactions.

Each Incoterm clarifies:

- Who pays for what (freight, insurance, duties)

- Where the risk transfers from seller to buyer

- Who handles logistics at different stages

These terms are recognized globally and appear on commercial invoices, sales contracts, and shipping documents.

2.Why Is the Incoterms Chart Important?

An Incoterms chart provides a visual overview of the logistics responsibilities shared between buyer and seller. It answers key questions such as:

- Who pays for shipping?

- Who is responsible for customs clearance?

- At what point is risk transferred?

This chart is essential for logistics professionals who want to avoid disputes, delays, or unexpected costs.

3.The 11 Incoterms Explained (2020 Edition)

Here’s a simplified explanation of the 11 official Incoterms, grouped into two categories:

For Any Mode of Transport:

| Incoterm | Description |

|---|---|

| EXW (Ex Works) | Buyer takes full responsibility from seller’s premises. |

| FCA (Free Carrier) | Seller delivers goods to the buyer’s carrier. |

| CPT (Carriage Paid To) | Seller pays freight, but risk transfers earlier. |

| CIP (Carriage and Insurance Paid To) | Like CPT, but with added insurance by seller. |

| DAP (Delivered at Place) | Seller delivers to the named destination, buyer handles import. |

| DPU (Delivered at Place Unloaded) | Seller unloads goods at destination. |

| DDP (Delivered Duty Paid) | Seller handles everything, including import duties. |

For Sea and Inland Waterway Transport:

| Incoterm | Description |

|---|---|

| FAS (Free Alongside Ship) | Seller delivers next to ship at port. Buyer handles loading. |

| FOB (Free On Board) | Risk transfers once goods are loaded on the ship. |

| CFR (Cost and Freight) | Seller pays freight; buyer takes on risk after loading. |

| CIF (Cost, Insurance & Freight) | Same as CFR, but seller also pays for marine insurance. |

4.Advantages of Using Incoterms

By understanding what’s included in each Incoterm, buyers and sellers can better control costs. You may choose an Incoterm that shifts more responsibility to the party with better logistics capabilities or lower costs.

Every Incoterm specifies the exact point at which risk transfers from seller to buyer. Knowing this helps businesses plan for insurance, liability, and logistics more effectively.

Incoterms clearly outline who is responsible for what, from freight costs to risk management. This eliminates confusion and reduces the chance of disputes between buyers and sellers.

Because Incoterms are internationally recognized, they act as a universal language in trade contracts. This is especially valuable when dealing with partners across different time zones, languages, and legal systems.

Using Incoterms gives both parties a clear framework for negotiation. It allows for transparency on logistics responsibilities and helps finalize deals faster with fewer legal complications.

Certain Incoterms simplify the customs process by making clear who handles export/import declarations, duties, and clearance. This helps prevent regulatory delays and fines.

5.How to Use the Incoterms Chart in Real Life

Let’s say you’re an importer in the US buying goods from a manufacturer in China. Here’s how different Incoterms might affect your shipment:

- EXW: You’ll need to arrange everything—from picking up the goods in China to clearing them in the US.

- FOB: The seller will handle getting goods onto the ship; you handle everything after.

- DDP: The seller arranges everything and even pays import duties. It’s the most convenient for you—but likely the most expensive.

Choosing the right Incoterm depends on:

- Your experience with logistics

- Control preferences

- Budget and risk tolerance

6. Choosing the Right Incoterm

| Situation | Recommended Incoterm |

|---|---|

| You want full control & lower cost | EXW or FOB |

| You want seller to handle most logistics | DDP or DAP |

| You’re shipping by sea only | FOB, CIF, or CFR |

| You want insurance included | CIP or CIF |

| You’re unsure about customs | DDP (seller handles it) |

7. Common Mistakes When Using Incoterms

1.Mixing old and new Incoterms

Always use the latest version (Incoterms 2020 as of now).

2.Assuming Incoterms cover everything

They don’t handle payment terms, ownership, or breach of contract issues.

3.Not specifying the location clearly

Always include the named place, e.g., FOB Shanghai Port, China.

Final Thoughts

The Incoterms chart is more than a visual—it’s a logistics tool that keeps global trade clear and efficient. Understanding the responsibilities laid out in each term helps both buyers and sellers avoid costly mistakes.

Whether you’re a beginner or seasoned trader, using the right Incoterm in your contracts will save you time, stress, and money.

Ask for a quote

TJ China Freight Forwarder helps global importers choose the most cost-effective Incoterms and manage end-to-end shipping from China.

Let us handle the complexities while you focus on growing your business.

FAQs

Q1: Do Incoterms cover payment terms?

No. Incoterms only define responsibilities for transport and risk. Payment terms should be specified separately.

Q2: Which Incoterm is best for new importers?

DDP is best for beginners since the seller handles almost everything.

Q3:Can Incoterms be customized?

Yes, but it’s crucial to clearly state all changes in the sales contract.

Q4: Is insurance required in all Incoterms?

Only CIP and CIF require the seller to provide insurance. In others, it’s optional.

Q5: What’s the difference between FOB and CIF?

Both are used for sea freight. In CIF, the seller also pays for insurance; in FOB, they don’t.