- By TOP CHINA FREIGHT

- August 11, 2025

- Shipping

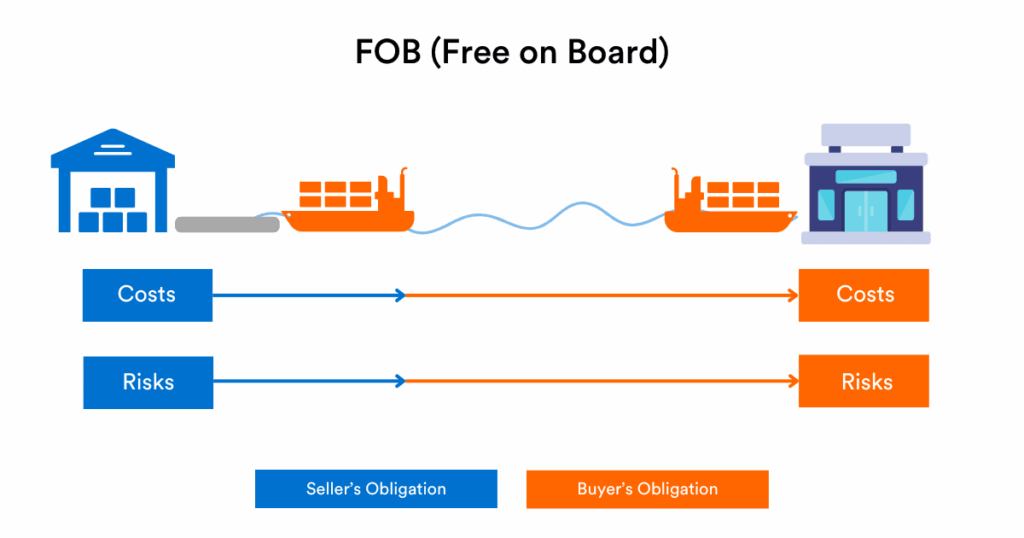

FOB — Free On Board is one of the most commonly used Incoterms in international trade, where clear agreements on shipping terms are essential to ensure smooth transactions and avoid misunderstandings.This term defines the responsibilities, costs, and risk transfer point between the buyer and seller during the shipment of goods by sea or inland waterway.

1.What is FOB?

FOB stands for Free On Board, an Incoterm issued by the International Chamber of Commerce (ICC) that specifies when the seller’s responsibility ends and the buyer’s begins during a sea shipment. Under FOB terms, the seller fulfills their obligation when the goods have been loaded onto the vessel at the named port of shipment. From this point onwards, all risks and costs transfer to the buyer.

This means that the seller is responsible for all activities and costs involved in preparing the goods, clearing them for export, and loading them on board the ship. Once the cargo is safely aboard the vessel, the buyer takes over responsibility, including sea freight, insurance, unloading costs, and import duties.

2.Detailed Responsibilities of the Seller

The seller is responsible for providing the buyer with necessary documents such as the commercial invoice, packing list, and bill of lading or equivalent proof of shipment.

The seller must package the goods appropriately for maritime transport and ensure they meet all quality and quantity requirements agreed upon.

The seller must deliver the goods to the named port and bear all costs and risks involved in transporting the goods to the port and loading them onto the vessel. This includes terminal handling charges at the origin port.

The seller handles all export formalities, including obtaining necessary licenses and customs clearance, ensuring the shipment complies with the regulations of the exporting country.

3.Detailed Responsibilities of the Buyer

The buyer pays for the sea freight charges and any related shipping costs from the port of shipment to the destination port.

While FOB does not require the seller to arrange insurance, it is usually advisable for the buyer to insure the goods for the sea voyage, as the risk transfers once goods are on board.

The buyer arranges and pays for transporting the goods from the destination port to their final location, whether a warehouse, factory, or retail outlet.

Upon arrival, the buyer is responsible for unloading costs at the destination port, customs clearance, and any import duties or taxes.

From the moment the goods pass the ship’s rail, the buyer assumes the risk of loss or damage.

4.Why Use FOB?

FOB is a widely accepted and straightforward Incoterm for maritime shipments, especially in containerized cargo and bulk shipments. It benefits both parties by clearly defining the point of risk transfer, simplifying negotiation of responsibilities.

For Sellers:

FOB limits their liability to the origin port, allowing them to focus on domestic operations.

For Buyers:

It gives more control over freight arrangements, choice of carriers, and insurance coverage.

5.FOB Variants: FOB Origin and FOB Destination

Though FOB is traditionally used in maritime shipping, in some contracts, especially in the US, terms like FOB Origin and FOB Destination appear. These specify whether risk and title transfer occur at the seller’s shipping location (origin) or at the buyer’s receiving location (destination). However, these are not part of the official ICC Incoterms and can cause confusion if not clearly defined.

6.Common Misunderstandings About FOB

For international road freight within Europe and beyond, the CMR document set

1.FOB Does Not Include Insurance:

Unlike CIF (Cost, Insurance, and Freight), FOB does not require the seller to purchase marine insurance for the shipment. The buyer should consider obtaining insurance to protect their interests during transit.

2.FOB is Only for Sea and Inland Waterway Transport:

FOB is not suitable for air or land transport. For those modes, other Incoterms like FCA (Free Carrier) are more appropriate.

3.FOB Does Not Mean the Buyer Pays for Loading:

Under FOB, the seller covers loading costs onto the vessel, but the buyer pays for sea freight and onward transport.

7.FOB Compared with Other Incoterms

| Incoterm Comparison | FOB (Free On Board) | Other Incoterms |

|---|---|---|

| FOB vs. CIF | Risk transfers to buyer once goods are loaded; buyer pays freight and insurance. | Seller pays freight and insurance to destination port; risk transfers at loading. |

| FOB vs. EXW (Ex Works) | Seller responsible for loading goods on vessel; obligation ends at ship’s rail. | Seller’s responsibility ends when goods are available at premises; buyer handles all transport. |

| FOB vs. FCA (Free Carrier) | Applies only to sea/inland waterway transport; seller loads goods on vessel. | Applies to all transport modes; seller hands over goods to carrier at named place, not necessarily on board. |

8.Risks Associated with FOB and How to Mitigate Them

While FOB provides clarity, several risks remain:

1.Damage or Loss During Loading:

The seller is responsible up to loading, but mishandling during this phase can cause disputes. Detailed inspections and documentation before loading can reduce risk.

2.Shipping Delays and Vessel Issues:

After loading, buyers bear risks like vessel delays, strikes, or detentions. Proactive communication with shipping lines and contingency planning helps.

3.Customs and Regulatory Risks:

Import duties, inspections, or bans can delay goods. Buyers must ensure compliance with destination country rules.

4.Insurance Gaps:

Since the seller doesn’t arrange insurance under FOB, buyers must carefully assess coverage needs for sea transit and beyond.

9.Important Considerations for Using FOB

| Key Consideration | Details |

|---|---|

| Specify the Named Port | Always clearly specify the port of shipment to avoid confusion or disputes. |

| Agree on Shipping Vessel | Buyer usually arranges the vessel and freight, but seller must load goods onto the agreed ship. |

| Document Handling | Both parties should agree on documentation requirements to ensure smooth customs clearance and payment. |

| Insurance Planning | Insurance is not included under FOB; buyers should evaluate risks and secure appropriate coverage. |

10.How FOB Works in Practice: Step-by-Step

1.Contract Agreement:

Buyer and seller agree to use FOB terms and specify the named port of shipment.

2.Seller Prepares Goods:

Seller packages goods and completes export customs clearance.

3.Transport to Port:

Seller delivers goods to the named port and loads them onto the vessel chosen by the buyer.

4.Risk Transfer:

Once goods are on board, risk and ownership transfer to the buyer.

5.Buyer Arranges Shipping:

Buyer arranges and pays for ocean freight, insurance (if desired), and import customs clearance.

6.Delivery at Destination:

Buyer pays destination port charges and arranges transport to the final destination.

Conclusion

The Incoterm FOB (Free On Board) remains a cornerstone in international maritime shipping, offering a clear division of responsibilities and risks between sellers and buyers. Understanding FOB helps businesses negotiate contracts effectively, manage costs wisely, and avoid unnecessary disputes. Whether you are a seller preparing goods or a buyer managing logistics, mastering FOB terms ensures smoother, more predictable trade transactions.

Ask for a quote

If you want expert guidance and peace of mind, our team is ready to assist.

TJ China Freight offers tailored solutions to help businesses of all sizes ship more reliably from China.

FAQs

Q1:Can FOB be used for air or land shipments?

No. FOB applies exclusively to sea or inland waterway transport. For other modes, FCA (Free Carrier) or other Incoterms are recommended.

Q2:Who arranges the vessel under FOB?

Usually, the buyer selects and contracts the vessel for shipment, though the seller loads the goods onto the vessel at the port.

Q3:What happens if goods are damaged after loading but before arrival?

Risk transfers to the buyer once goods are on board. The buyer’s insurance should cover loss or damage during transit.

Q4:Does FOB include unloading costs at the destination port?

No, unloading and onward transport costs after the destination port are the buyer’s responsibility.

Q5:How does FOB impact payment terms?

Typically, sellers provide the bill of lading as proof of shipment to the buyer or buyer’s bank for payment under Letters of Credit.