- By TOP CHINA FREIGHT

- August 12, 2025

- Shipping

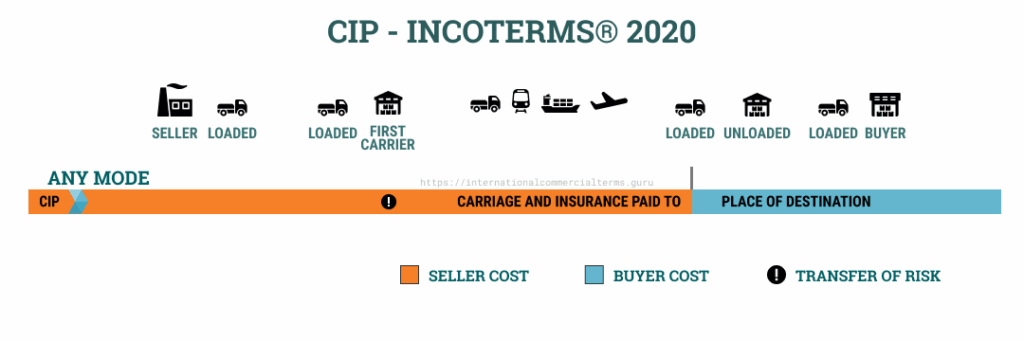

The Incoterm CIP, which stands for Carriage and Insurance Paid To, is one of the most versatile and widely used shipping terms that define who pays for transportation and insurance — and at what point risk transfers from seller to buyer.Understanding CIP shipping terms is crucial for importers, exporters, freight forwarders, and logistics professionals to ensure smooth transactions and avoid costly disputes.

1.What Is CIP in Shipping?

CIP is an Incoterm published by the International Chamber of Commerce that applies to any mode of transport, including multimodal shipments (combinations of sea, air, rail, and road). It requires the seller to:

- Arrange and pay for carriage (transport) of the goods to a specified destination.

- Provide insurance coverage for the goods during transit.

However, the critical point is that the risk transfers to the buyer once the goods are handed over to the first carrier, not at the destination. This means the seller handles the transportation and insurance costs up to the agreed location, but the buyer assumes the risk of loss or damage from the moment the goods leave the seller’s control.

2.Seller’s Obligations Under CIP

The seller’s responsibilities under CIP are quite comprehensive:

1.Delivery to Carrier

The seller must deliver the goods to the first carrier or another person nominated by the seller at the agreed place of shipment.

2.Payment for Carriage

The seller covers all costs necessary to transport the goods to the named destination.

3.Insurance

The seller must obtain cargo insurance that covers the buyer’s risk during transit. The insurance should provide coverage equal to at least 110% of the contract value, generally using the Institute Cargo Clauses (A) or equivalent.

4.Export Customs Clearance

The seller is responsible for all export formalities, such as obtaining export licenses and clearing customs in the country of origin.

5.Provision of Documents

The seller must provide the buyer with sufficient documentation to prove that goods have been shipped, such as the commercial invoice, insurance policy, and transport documents (e.g., bill of lading or airway bill).

3.Buyer’s Obligations Under CIP

The buyer’s responsibilities begin once the goods have been delivered to the first carrier:

1.Assumption of Risk

The buyer assumes all risk of loss or damage after the goods have been handed over to the carrier.

2.Import Customs and Duties

The buyer must handle import clearance and pay any duties, taxes, or fees required to bring the goods into the destination country.

3.Onward Transport

If the goods need to be transported beyond the named destination, the buyer is responsible for arranging and paying for this.

4.Additional Insurance

If the buyer wants extra insurance coverage beyond what the seller arranges, the buyer must purchase it.

4.Why Use CIP?

CIP is ideal for buyers who want the seller to take care of transportation and insurance up to an agreed destination, but prefer to control risk once the goods are with the first carrier. Its flexibility makes it suitable for:

- Complex multimodal shipments.

- Situations where the buyer wants the seller to handle insurance.

- Trade involving high-value or fragile goods needing insurance protection.

5.CIP vs. Similar Incoterms

| Incoterm | Transport Mode | Seller Pays For | Risk Transfer Point | Insurance Required |

|---|---|---|---|---|

| CPT | Any (multimodal) | Carriage to named destination | When goods delivered to first carrier | No |

| CIP | Any (multimodal) | Carriage + Insurance to destination | When goods delivered to first carrier | Yes |

| CIF | Sea and inland waterway only | Carriage + Insurance to port | When goods pass ship’s rail at shipment port | Yes |

| DAP | Any (multimodal) | Carriage to named destination | When goods arrive at named destination, ready for unloading | No |

6.Important Points to Consider When Using CIP

- The seller chooses the insurance policy and provider, which might not align with the buyer’s preferences unless negotiated.

- The named destination must be clearly specified to avoid ambiguity.

- Since risk transfers at first carrier, buyers should understand that even though the seller pays for insurance to destination, risk during the main transit phase belongs to the buyer.

- CIP terms encourage cooperation but require careful contract drafting, especially regarding insurance coverage and claims procedures.

7.Real-World Example of CIP Shipping Terms

- A supplier in China sells machinery to a buyer in Germany, agreeing to CIP Hamburg Port.

- The supplier arranges transport from factory to the shipping port, pays freight charges to Hamburg, and obtains insurance covering the shipment.

- The supplier completes export customs procedures and provides the buyer with all shipping and insurance documents.

- Once the goods are handed to the first carrier in China, risk transfers to the buyer.

- Upon arrival in Hamburg, the buyer clears import customs, pays duties, and arranges onward transport to their facility.

8.CIP in Multimodal Shipping

CIP is particularly well-suited to multimodal transport, where goods are shipped using more than one transport mode (e.g., truck to rail to ship to truck). The seller is responsible for organizing the entire transportation chain and the insurance that covers the whole journey.

This flexibility makes CIP popular in modern supply chains where logistics complexity demands clear contractual frameworks.

9.Advantages of Using CIP

1.Seller control of insurance and carriage:

Sellers can negotiate better freight and insurance rates.

2.Predictable costs:

Buyers know upfront that carriage and insurance to the destination are covered.

3.Flexibility:

Applicable to all modes of transport and multimodal shipments.

4.Risk clarity:

Early risk transfer point clarifies responsibilities and reduces disputes.

10.Potential Drawbacks and Risks

1.Early risk transfer:

Buyers assume risk once goods are with the first carrier, which can be problematic if the first leg involves high-risk transit.

2.Insurance coverage disputes:

Buyers must trust the seller’s insurance arrangements unless otherwise specified.

3.Costs after destination:

Buyers may face unexpected charges after the goods arrive at the named place, such as unloading or customs delays.

Conclusion

The CIP shipping term strikes a practical balance in international trade, placing carriage and insurance responsibilities on the seller while transferring risk to the buyer early in the shipping process. Its applicability to all transport modes and requirement for insurance make it a preferred choice for many complex shipments.By clearly understanding CIP’s cost, risk, and insurance allocations, both buyers and sellers can negotiate contracts that protect their interests and streamline logistics.

Ask for a quote

If you want expert guidance and peace of mind, our team is ready to assist.

TJ China Freight offers tailored solutions to help businesses of all sizes ship more reliably from China.

FAQs

Q1:Who is responsible for insurance under CIP?

The seller is responsible for purchasing insurance that covers the goods during transport to the named destination. This insurance must cover at least 110% of the contract value.

Q2:When does risk transfer from the seller to the buyer in CIP?

Risk transfers when the goods are delivered to the first carrier or another party nominated by the seller, even though the seller continues to pay for carriage and insurance.

Q3:Can CIP be used for sea freight only?

No, CIP is valid for any mode of transport, including sea, air, road, rail, or multimodal shipments.

Q4:Does CIP require the seller to handle import customs clearance?

No, the buyer is responsible for import customs clearance, including duties, taxes, and fees, at the destination country.

Q5:What happens if goods are damaged after delivery to the first carrier?

Since the buyer assumes risk after the goods are handed over, the buyer can claim compensation through the insurance purchased by the seller.