The China to Europe train route map reveals a logistics lifeline that connects inland China with European markets. Although sea freight dominates trade, rail freight is gaining importance due to balanced cost, speed, and sustainability. Businesses that rely on timely delivery increasingly explore this option.

What Does the China to Europe Train Route Map Show?

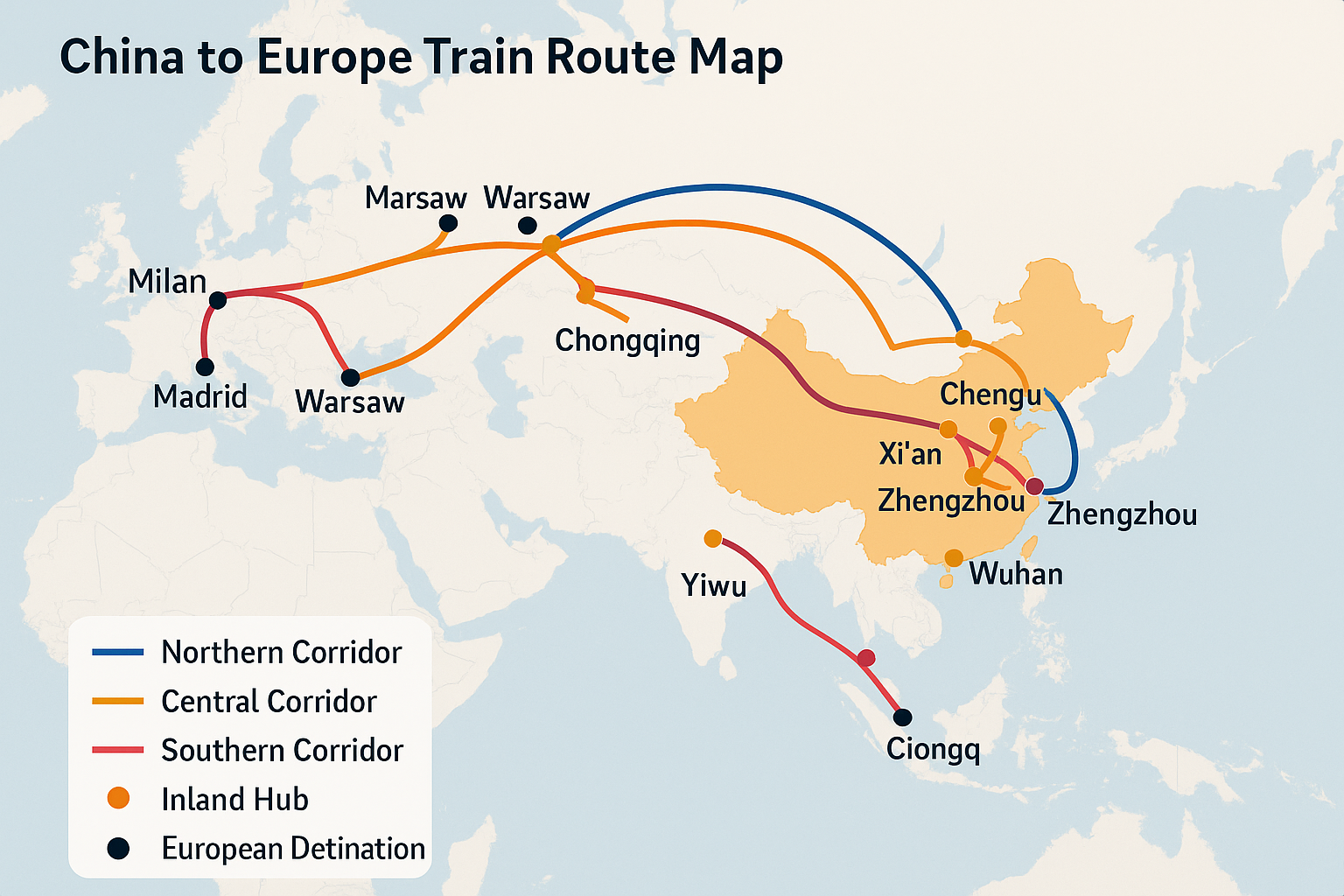

The map highlights three main rail corridors crossing Eurasia:

- Northern Corridor – via Russia, serving Moscow and northern Europe.

- Central Corridor – via Kazakhstan, Belarus, and Poland, leading to Germany.

- Southern Corridor – via Turkey, extending to Spain and Italy.

Additionally, the map shows Chinese inland hubs such as Chongqing, Chengdu, Xi’an, Zhengzhou, Wuhan, and Yiwu, which serve as starting points.

Northern, Central, and Southern Routes Explained

Northern Corridor (via Russia)

This line passes through Mongolia and Russia, reaching European Russia and Germany. It is widely used for heavy industrial goods.

Central Corridor (via Kazakhstan–Belarus–Poland)

The most popular route, connecting Xi’an or Zhengzhou to Duisburg and Hamburg. Moreover, it avoids maritime congestion.

Southern Corridor (via Turkey)

The emerging path links China through Kazakhstan and Turkey to southern Europe, including Milan and Madrid. Although less frequent, it provides diversification.

Key European Hubs on the Map

- Duisburg (Germany): Europe’s largest inland port, handling 30% of all China–Europe rail freight.

- Warsaw (Poland): A central hub for Eastern and Central Europe distribution.

- Hamburg (Germany): Gateway for northern Europe, linking with Scandinavian markets.

- Madrid (Spain): The longest direct line from Yiwu, supporting south European trade.

- Milan (Italy): Vital hub for textiles and fashion-related imports.

Real Case Studies Along the Route Map

Case 1: Chengdu → Duisburg (Machinery)

- Goods: 40HQ container of machinery parts

- Mode: FCL rail freight

- Cost: USD 8,500

- Transit Time: 18 days

- Benefit: Faster supply for European factories than sea freight.

Case 2: Wuhan → Milan (Textiles)

- Goods: 20GP container of apparel

- Mode: FCL rail freight

- Cost: USD 4,900

- Transit Time: 19 days

- Benefit: Delivered before fashion season deadlines.

How Does Geopolitics Shape the Train Route Map?

Geopolitical stability directly influences the train route map:

- Russia sanctions: Affect northern corridor usage.

- Kazakhstan–Belarus: Remain critical for central routes.

- Turkey corridor: Gains importance as diversification strategy.

In addition, EU subsidies and Belt and Road initiatives support long-term sustainability of rail freight.

Transit Times by Major Routes

| Origin Hub | Destination | Transit Time |

|---|---|---|

| Xi’an | Duisburg | 15–17 days |

| Zhengzhou | Hamburg | 16–19 days |

| Chongqing | Warsaw | 16–18 days |

| Yiwu | Madrid | 18–20 days |

Accordingly, the map highlights average delivery speed, much shorter than sea freight’s 30–40 days.

Customs and Border Procedures Along the Map

The rail route map shows multiple borders requiring customs clearance:

- China exit customs (Chongqing, Xi’an, etc.)

- Kazakhstan entry at Alashankou or Khorgos

- Poland entry at Malaszewicze (key EU gateway)

Moreover, gauge change is required from broad-gauge to standard-gauge rails, which may add one or two days to transit.

Pros and Cons of Rail Freight in the Route Map Context

| Pros | Cons |

|---|---|

| Faster than sea freight | Costlier than sea freight |

| Cheaper than air freight | Border delays possible |

| Direct inland connections | Limited frequency vs. sea |

| Lower CO₂ emissions | Sensitive to geopolitical issues |

Therefore, rail is a strategic middle-ground solution.

How Much Does Rail Freight Cost Along the Map?

| Cargo Type | Avg. Cost (USD) | Notes |

|---|---|---|

| 20GP | 4,000–5,500 | Depends on route |

| 40HQ | 7,000–9,000 | Most popular for exports |

| LCL per CBM | 180–250 | Consolidation services |

Furthermore, surcharges may apply for fuel or special handling.

Conclusion

In summary, the China to Europe train route map shows three strategic corridors linking inland China to European hubs. Rail freight reduces lead times to 15–20 days, supports sustainable logistics, and provides balance between cost and delivery speed.

Real cases from Chengdu, Wuhan, and Yiwu illustrate practical applications. Consequently, businesses seeking reliable supply chains should consider rail as a serious alternative to sea or air freight.

- Consult TJ China Freight Forwarding for the lowest quote. They will provide you with reliable, cost-effective service.

FAQs

Q1.Which corridor is fastest on the China to Europe train route map?

The central corridor via Kazakhstan and Belarus is fastest, offering reliable schedules and strong connections to Germany and Poland.

Q2.How do gauge changes impact China to Europe rail shipments?

Gauge changes at borders require transshipment, usually adding one to two days but managed efficiently with specialized equipment.

Q3.What European hubs dominate the China to Europe train route map?

Duisburg, Hamburg, Warsaw, Madrid, and Milan dominate rail hubs, ensuring efficient distribution networks across Europe.

Q4.Can perishable goods use China to Europe rail freight?

Yes, refrigerated containers allow controlled temperature shipments, ensuring perishable goods remain fresh during 15–20 day transits.

Q5.How does Belt and Road influence the train route map?

The Belt and Road initiative expands rail infrastructure, improves connectivity, and promotes new trade corridors between China and Europe.