- By TOP CHINA FREIGHT

- August 12, 2025

- Shipping

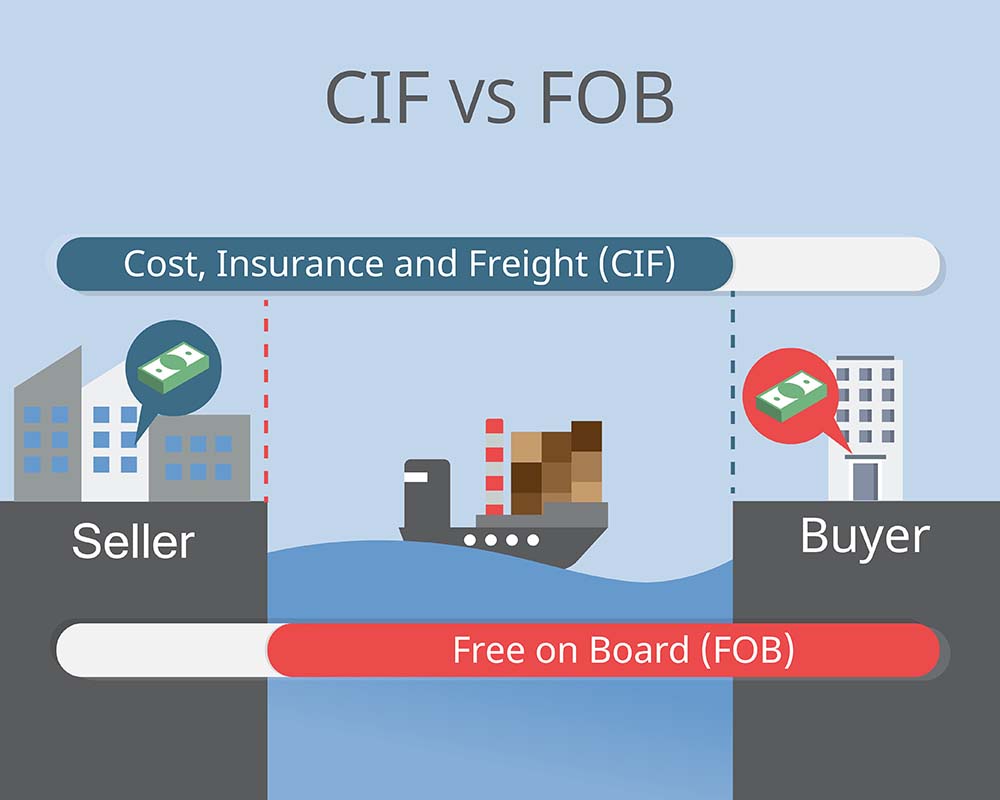

International trade depends heavily on clear terms that define responsibilities, risks, and costs between buyers and sellers. FOB (Free on Board) and CIF (Cost, Insurance, and Freight) are two of the most commonly used Incoterms. Choosing between them can significantly impact logistics, cost management, and risk exposure.This article offers an in-depth comparison of FOB and CIF, helping businesses decide which term suits their needs best.

1.What Is FOB (Free on Board)?

FOB means the seller delivers the goods onto the vessel nominated by the buyer at the agreed port of shipment. Once the goods are on board, risk and responsibility pass to the buyer.

Key seller responsibilities under FOB:

- Packaging and labeling goods appropriately

- Clearing goods for export customs

- Delivering goods to the loading port

- Loading goods onto the ship

Key buyer responsibilities:

FOB Risk and Cost Transfer Point

| Stage | Responsible Party | Notes |

|---|---|---|

| Pre-loading preparation | Seller | Packaging, documentation |

| Loading goods onto vessel | Seller | Risk shifts after loading |

| During sea transit | Buyer | Responsible for risk and cost |

| Arrival and unloading | Buyer | Handles unloading and onward transport |

2.What Is CIF (Cost, Insurance, and Freight)?

CIF places more responsibility on the seller, who must pay for goods, freight to the destination port, and minimum insurance coverage during transit.

Seller’s responsibilities include:

- Preparing and packaging goods

- Export customs clearance

- Booking and paying freight charges

- Arranging insurance covering most transit risks

Buyer’s responsibilities:

- Import customs clearance

- Unloading at destination port

- Inland transportation from port to final destination

CIF Risk and Cost Transfer Point

| Stage | Responsible Party | Notes |

|---|---|---|

| Pre-loading preparation | Seller | Packaging, documentation |

| Loading goods onto vessel | Seller | Risk transfers to buyer at loading point |

| Sea transit | Seller (insurance covered) | Seller arranges insurance; risk technically with buyer after loading |

| Arrival and unloading | Buyer | Unloading, customs, inland transport |

3.Detailed Comparison: FOB vs CIF

| Aspect | FOB (Free on Board) | CIF (Cost, Insurance, and Freight) |

|---|---|---|

| Who pays freight? | Buyer | Seller |

| Who arranges insurance? | Buyer | Seller |

| Risk transfer point | When goods pass ship’s rail at port of shipment | Same as FOB (ship’s rail), but seller pays insurance |

| Control over shipment | Buyer controls carrier, route, and insurance | Seller controls shipment and insurance |

| Suitable for | Buyers with logistics experience | Buyers wanting convenience and less responsibility |

| Cost predictability | Variable (buyer negotiates rates) | More predictable (seller includes shipping and insurance) |

| Customs and documentation | Seller handles export; buyer handles import | Seller handles export; buyer handles import |

Why Does the Difference Matter?

- FOB: Buyers can shop for competitive freight and insurance rates, potentially lowering costs.

- CIF: Costs are bundled and included in the seller’s invoice, simplifying budgeting but sometimes higher.

- Both terms transfer risk at the port of shipment loading.

- However, under CIF, the seller must provide insurance covering most risks during the sea transit, which offers buyers extra protection.

- FOB buyers have full control over shipping schedules, carriers, and insurance policies.

- CIF buyers rely on sellers to manage these elements, which might reduce control but also reduce complexity.

4.Real-World Scenario Example

Imagine a U.S. company importing electronics from China:

| Aspect | FOB Agreement | CIF Agreement |

|---|---|---|

| Freight costs | Buyer negotiates freight with shipping line | Seller includes freight costs in price |

| Insurance | Buyer arranges insurance for shipment | Seller provides insurance |

| Risk control | Buyer assumes risk once goods loaded in China | Buyer assumes risk at loading, but insurance is provided |

| Customs at destination | Buyer arranges import clearance and duties | Buyer responsible for import duties, unloading |

This example shows how the choice affects cost, risk, and operational tasks.

5.When to Choose FOB vs CIF?

| Business Type / Situation | Recommended Term | Reasoning |

|---|---|---|

| Experienced importers | FOB | More control, potential cost savings |

| First-time or small importers | CIF | Less hassle, seller manages shipping & insurance |

| Buyers wanting flexible shipping options | FOB | Buyer chooses carriers/routes |

| Buyers preferring bundled costs | CIF | Predictable all-in cost |

6.Common Misconceptions About FOB and CIF

| Misconception | Reality |

|---|---|

| CIF means seller owns goods until delivery | Seller’s responsibility ends once goods are loaded; buyer assumes risk after that point |

| FOB means seller pays all costs until delivery | Seller only pays up to loading; buyer pays freight and insurance |

| Insurance is optional under CIF | Seller must arrange minimum insurance under CIF |

| FOB and CIF risk transfer points differ | Both transfer risk at the ship’s rail during loading |

Conclusion

Understanding FOB vs CIF is essential for anyone involved in international trade. FOB offers buyers greater control and flexibility, suitable for those with logistics expertise. CIF, on the other hand, simplifies the shipping process by placing more responsibility on the seller, including insurance and freight costs. By analyzing your business needs, experience level, and preference for control versus convenience, you can select the most appropriate Incoterm. This decision directly impacts costs, risk management, and operational complexity — all critical to successful global trade.

Ask for a quote

If you want expert guidance and peace of mind, our team is ready to assist.

TJ China Freight offers tailored solutions to help businesses of all sizes ship more reliably from China.

FAQs

Q1: At what point does risk transfer from seller to buyer under FOB and CIF?

For both FOB and CIF, the risk transfers from the seller to the buyer once the goods pass the ship’s rail at the port of shipment. However, under CIF, the seller still provides insurance coverage during transit.

Q2:Who is responsible for arranging insurance in FOB and CIF shipments?

Under FOB, the buyer arranges and pays for insurance. Under CIF, the seller must arrange and pay for insurance that covers the goods during sea transit up to the destination port.

Q3:Does CIF cover all types of transport modes?

CIF is specifically used for sea and inland waterway transport only. It is not suitable for air, rail, or road freight.

Q4:Can buyers negotiate freight costs under CIF?

Generally, no. Under CIF, the seller arranges and pays for freight, so buyers have less control over carrier selection and freight charges compared to FOB.

Q5: Which Incoterm is better for new importers?

CIF is often better for newcomers because the seller handles many logistics details such as freight and insurance, reducing the complexity for the buyer.