- By TOP CHINA FREIGHT

- September 12, 2024

- Service, Shipping

China is Australia’s largest trading partner and the primary source of imports. The key imports from China to Australia include:

- Electrical products (HS code: 85)

- Machinery (HS code: 84)

- Furniture and bedding (HS code: 94)

- Vehicles and accessories (HS code: 87)

Though shipping from China to Australia may seem complicated, with the right information, it can become straightforward. Read on to discover the best freight shipping options for your needs today.

Australia Imports Licenses/Permits

Australia’s Customs office, known as the Australian Border Force (ABF), monitors all items entering the country. Importers do not need an import license to bring goods into Australia. However, businesses must register for GST purposes and obtain an Australian Business Number (ABN) to claim input tax credits or access the GST deferral scheme.

Australia Imports De Minimis – AUD1,000

For goods valued at AUD1,000 or less, there are no duties, taxes, or charges. However, for goods above AUD1,000, you must pay all relevant duties, taxes, and fees.

Timber and Bamboo Packaging

Australia enforces strict conditions on timber and bamboo packaging due to biosecurity concerns. Packaging is grouped into three categories:

- Permitted packaging materials

- Packaging with solid timber (ISPM 15)

- Packaging containing bamboo

For containerized cargo, suppliers must complete a packing declaration, which is mandatory for Full Container Load (FCL) and Less than Container Load (LCL) consignments but not required for air or break bulk cargo.

Australia Import Clearance Declaration Cost

All imported goods are subject to duties and taxes unless a specific exemption applies. For customs clearance, the minimum required documents include a Customs Entry or Informal Clearance Document (ICD), an air waybill (AWB) or bill of lading (BOL), along with invoices and other relevant documents.

When invoiced in a foreign currency, the value of imported goods must be converted into AUD using the exchange rate on the day of export.

Customs Import Processing Charges

| Consignment Value | Cargo Channel | Charge (AUD) |

|---|---|---|

| ≤ $1,000 | Sea / Air / Post | $0 |

| > $1,000 – < $10,000 | Sea / Air / Post | $50 |

| ≥ $10,000 | Sea / Air / Post | $152 |

Customs Duties

Importers are responsible for self-assessing the tariff classification of their goods. Incorrect classification or misleading information can result in penalties.

China-Australia Free Trade Agreement (ChAFTA)

The China-Australia Free Trade Agreement (ChAFTA), which came into effect in December 2015, has eliminated tariffs on 82% of China’s exports to Australia, with 100% tariff elimination achieved by 2019. You can use the FTA portal to check the preferential FTA tariff rate on your product and to verify if your product meets the Rules of Origin (ROO) requirements.

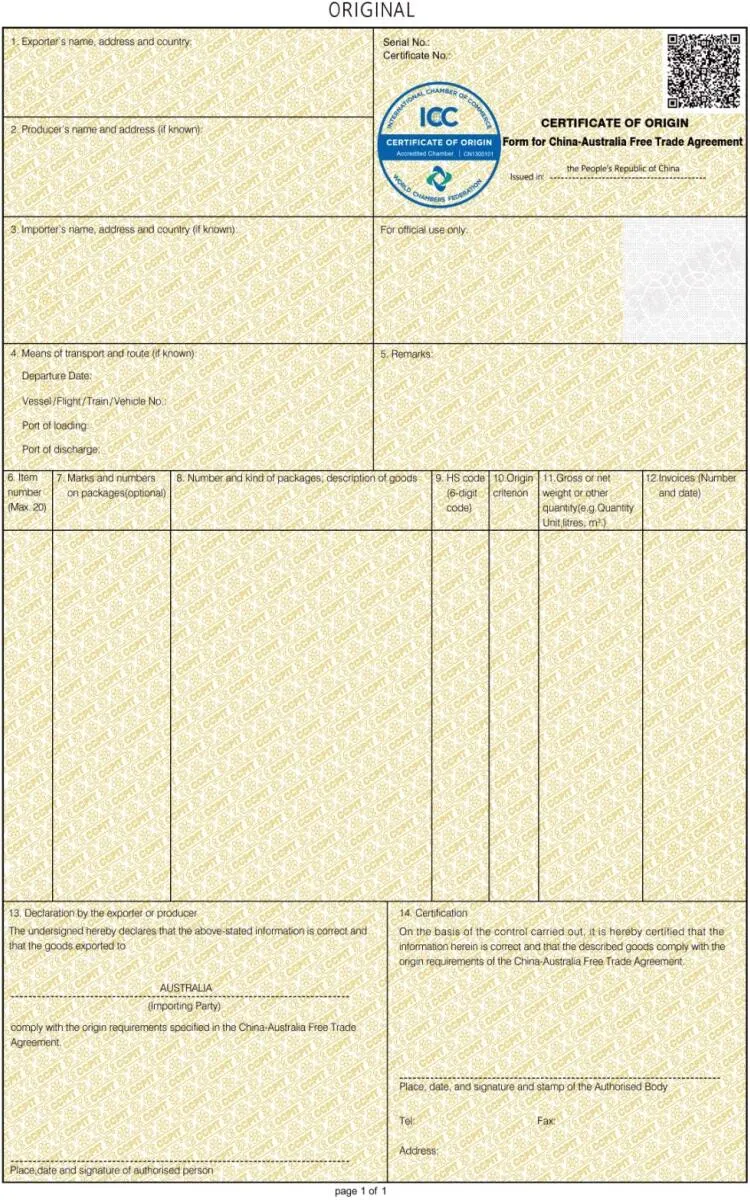

China-Australia Certificate of Origin

If your goods qualify for preferential tariffs, you will need a ChAFTA Certificate of Origin (COO). This document, issued by an authorised body in China, may be requested by Australian customs authorities.

For importers, China Customs Service (GACC) or the China Council for the Promotion of International Trade (CCPIT) can issue a COO, which is valid for one shipment and covers up to 20 unique goods.

Customs GST – 10%

A Goods and Services Tax (GST) of 10% is applied to the customs value, international transport, and customs duty of imported goods.

Sea Freight to Australia

Australia’s coastline is home to numerous key ports that facilitate international trade. Below are some of the top container ports:

| Port | State | Main Operators |

|---|---|---|

| Port of Sydney | NSW | Patrick Terminals, DP World Sydney, Sydney International Container Terminals |

| Port of Melbourne | VIC | Patrick Terminals, DP World Melbourne, Victoria International Container Terminal |

| Port of Brisbane | QLD | Patrick Terminals, DP World Brisbane |

| Port of Fremantle | WA | Patrick Terminals, DP World Fremantle |

| Port of Adelaide | SA | Flinders Port Holdings |

| Port of Darwin | NT | Darwin Port |

FCL vs LCL Shipping

Choose between Full Container Load (FCL) or Less than a Container Load (LCL) based on your shipment needs. LCL allows you to share container space, while FCL offers more control but is typically used when filling over half of the container.

Sea Freight Cost

Shipping costs vary based on:

- Type of freight

- Cargo dimensions, weight, and volume

- Shipping mode: LCL or FCL

- Delivery method: Door-to-door, port-to-door, port-to-port, or door-to-port

Sea Freight Transit Time

Typically, shipping from China to Australia by sea takes around 20 days.

Air Freight to Australia

Air freight is ideal for businesses with urgent shipments or perishable goods. It offers greater speed and security than sea freight, making it a preferred option for high-value items.

| IATA Code | Airport Name | City |

|---|---|---|

| SYD | Sydney Kingsford Smith International Airport | Sydney |

| BNE | Brisbane International Airport | Brisbane |

| MEL | Melbourne International Airport | Melbourne |

| PER | Perth International Airport | Perth |

| CNS | Cairns International Airport | Cairns |

| ADL | Adelaide International Airport | Adelaide |

| DRW | Darwin International Airport | Darwin |

Air Freight Cost

The cost of air freight depends on the shipment’s weight or size. Prices are based on either the volumetric weight or deadweight of the cargo, whichever is higher. Other fees may apply, depending on specific shipping requirements.

Air Freight Transit Time

| Service | Description |

|---|---|

| Next Day | Delivered within 24 to 48 hours |

| Premium Air | Delivered within 48 to 96 hours |

| Economy Air | Budget shipping with larger freight, slower delivery |

| International Courier | Delivered within three days (Door-to-Door) |

What TCF Can Do for You

TCF specializes in providing tailored logistics solutions that ensure your shipments arrive on time and in perfect condition. From packaging to customs clearance, TCF’s team of experts is here to help streamline the shipping process, allowing you to focus on your business.

Choose TCF to stay focused on your objectives and leave your shipping worries to us!