In 2025, importers and exporters worldwide are asking why freight price from China raised so much. Rising demand, container shortages, fuel costs, and global trade shifts have driven rates higher. This guide breaks down the main causes, current shipping conditions, and ways to control your logistics expenses.

1️⃣ Global Demand Outpacing Supply

Export orders surging, vessel space in short supply

- Background: In 2025, the global economic recovery outpaced expectations. Markets in the U.S., Europe, and the Middle East rushed to replenish inventory.

- Impact: Main trade lanes filled up 2–3 months before peak seasons, pushing freight rates higher.

- Example: The Shenzhen–Los Angeles route rose from USD 3,200 per 40HQ last year to over USD 5,000 today.

💡 Tip: Secure bookings early and ship in off-peak seasons to minimize cost spikes.

2️⃣ Container Imbalance — Shortage at Chinese Ports

Slow return of empty containers causes “box shortage” in China

| Region | Empty Container Retention | Main Cause |

|---|---|---|

| U.S. West Coast | 25% | Port congestion, extended turnaround time |

| Northern Europe | 18% | Reduced return voyages |

| African Ports | 12% | Irregular sailings + low handling speed |

📌 Result: Exporters pay extra Premium Surcharges to secure containers, adding to total freight costs.

3️⃣ Port Congestion & Delays

“One ship, long wait” remains common in 2025

- Pre-holiday shipment surges (Chinese New Year, Christmas)

- Labor shortages and port upgrade projects

- Extended customs and safety checks

- Vessel berthing wait time extended to 2–5 days

- Lower vessel turnover leads to higher freight rates

📍Example: During peak season at Ningbo Port, average berthing wait time reached 4.3 days, up by 2 days compared to off-peak.

4️⃣ Rising Bunker Fuel Prices

Fuel price trends mirror freight rate movements

🟢2025 Trend: Low-sulfur marine fuel (VLSFO) prices rose 18–22% compared to 2024.

🟢Drivers:

- Political instability in the Middle East affecting crude oil supply

- Production cuts by major oil-exporting nations

🟢Cost Pass-through: Every USD 50/ton increase in fuel cost may raise 40HQ freight rates by USD 100–150.

5️⃣ Trade Policy & Geopolitical Tensions

Policy shifts trigger route changes and extra fees

- Tariffs & Inspections: Increase clearance time and costs

- Route Adjustments: Avoiding high-risk areas extends transit times

- Security Surcharge: Additional USD 50–200/TEU on certain lanes

📍Example: China–Europe routes shifting from the Suez Canal to the Cape of Good Hope add 10–12 days and increase freight rates by over 20%.

6️⃣ Limited Shipping Capacity

New ships take time to deploy

🟢Reasons:

- New vessel construction takes 18–24 months

- Some vessels are offline for repairs or environmental retrofits (e.g., scrubbers)

🟢Impact: Even with rising demand, capacity recovery is slow, keeping space tight.

🟢Data: Global capacity increased ~3% in 2025, while demand grew over 5%.

Provide your shipment details — including weight, dimensions, destination, and preferred transport mode — to get a customized freight quote.

7️⃣ Seasonal Freight Price Surges

High-price periods to watch out for

| Period | Cause | Typical Increase |

|---|---|---|

| Jan–Feb (Pre-CNY) | Rush shipments before Chinese New Year | +15–25% |

| August (Back-to-School) | Stationery and home goods exports | +10–18% |

| Sep–Nov (Christmas Season) | Toys, gifts, and e-commerce restocking | +20–35% |

💡 Tip: Plan shipments 1–2 months in advance to avoid peak rate surges.

8️⃣ Shipping Times, Conditions & Common Terms

Route overview for 2025

| Route | Mode | Avg. Transit Time | Key Conditions Affecting Time & Price | Common Incoterms |

|---|---|---|---|---|

| China → U.S. West Coast | Sea Freight | 15–20 days | Port congestion, customs delays | FOB, CIF |

| China → U.S. East Coast | Sea Freight | 28–35 days | Panama Canal delays, seasonal peaks | FOB, CFR |

| China → Northern Europe | Sea Freight | 30–40 days | Suez diversions, fuel surcharges | EXW, DDP |

| China → Southeast Asia | Sea Freight | 5–10 days | Monsoon disruptions, limited space | FOB, CIF |

| China → Europe (Air Cargo) | Air Freight | 3–6 days | Airport slot availability, customs speed | FCA, CPT |

| China → Middle East | Sea Freight | 15–25 days | Political instability, security surcharges | FOB, CIF |

💡 Pro Tip: When booking, confirm both Incoterms and free days for containers to avoid unexpected detention and demurrage charges.

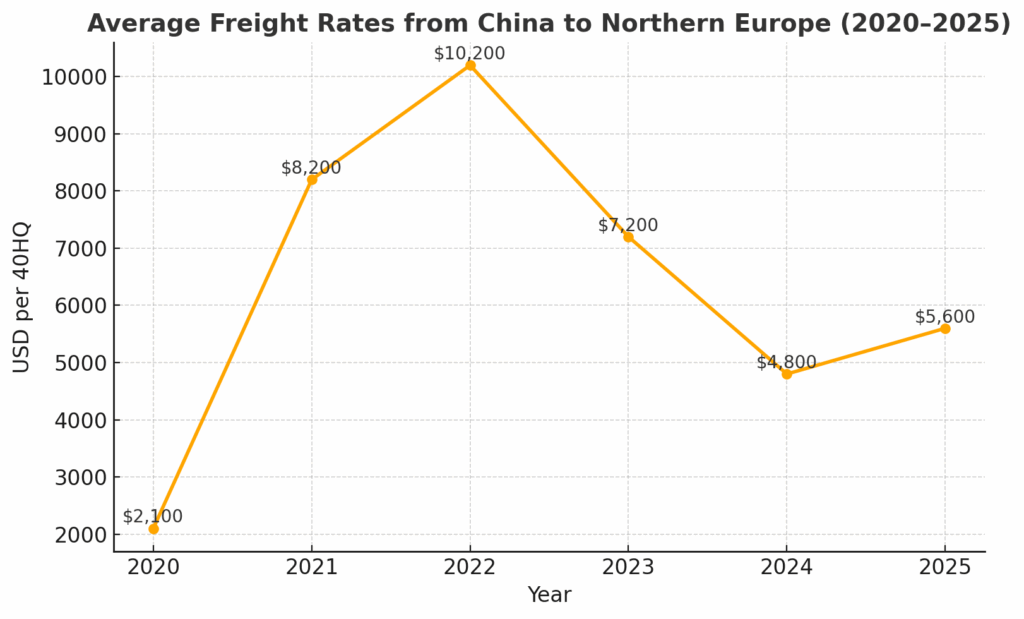

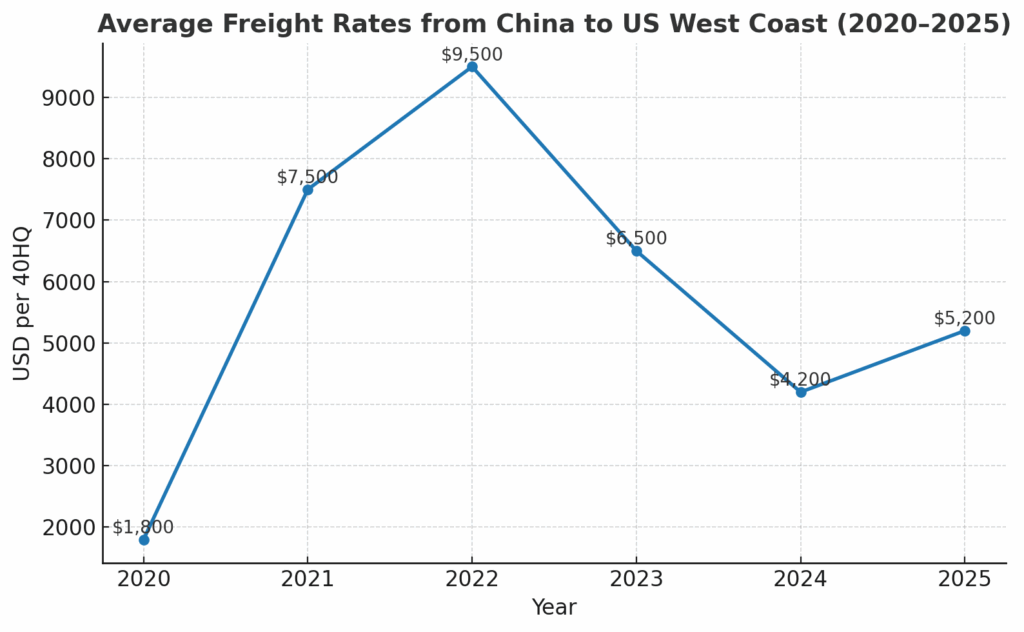

Freight Rate Trends Coast (2020–2025)

9️⃣ Key Takeaways

✅ Why freight price from China raised so much boils down to overlapping supply chain pressures:

- High global demand with limited vessel space

- Container shortages and port delays

- Rising bunker fuel costs

- Geopolitical and trade policy disruptions

📦 Action Steps:

- Ship outside peak seasons

- Negotiate longer-term contracts

- Use alternative routes or modes (rail, air) when viable

🔟 Conclusion — Navigating High Freight Prices in 2025

📌 The question “why freight price from China raised so much” cannot be answered by a single cause — it’s the result of overlapping global supply chain pressures including capacity limits, container shortages, fuel price volatility, and shifting geopolitical landscapes.

What importers & exporters should focus on in 2025:

- Plan Ahead: Book shipments well before peak seasons to secure space and competitive rates.

- Diversify Routes & Modes: Consider rail or air for urgent goods, or alternative ports to avoid congestion.

- Negotiate Contracts: Locking in long-term agreements can shield you from sudden price spikes.

- Track Market Trends: Regularly monitor freight indices, port updates, and global trade news to make informed decisions.

💡 While 2025 still poses cost challenges, strategic planning and flexible logistics management can help businesses stay competitive and protect their profit margins despite elevated freight prices.

Request a Quote

Need a tailored solution for your shipping from China?

Let TJ China Freight Forwarder assist you with reliable, cost-effective service.

FAQ:

Q1.What’s the difference between LCL and FCL shipping?

LCL (Less than Container Load) means your cargo shares space with other shipments, while FCL (Full Container Load) gives you the entire container.

Q2.How can weather impact shipping schedules?

Severe storms, typhoons, or icy conditions can close ports and delay sailings, especially on routes through the Pacific or Northern Europe.

Q3.Do freight forwarders offer cargo insurance?

Yes — most can arrange coverage against loss, damage, or theft during transit, often based on cargo value.

Q4.How does currency exchange affect freight prices?

Freight rates are often quoted in USD; fluctuations in local currency can raise or lower your costs when converted.

Q5.Can digital freight platforms help lower costs?

They can — real-time rate comparisons and automated booking sometimes secure better rates than traditional methods.