- By TOP CHINA FREIGHT

- September 29, 2025

- Shipping

Table of Contents

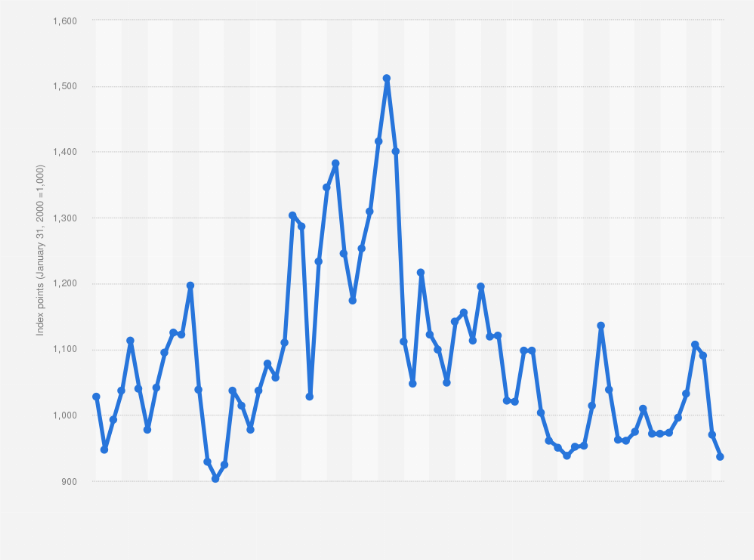

The China Coastal Bulk Freight Index (CCBFI) is a crucial benchmark for companies moving raw materials and bulk commodities along China’s extensive coastline. This index tracks freight rate fluctuations, helping importers, exporters, and logistics managers anticipate costs and optimize shipping schedules. Since transportation costs directly affect supply chain strategies, understanding how the index works can improve both budgeting and decision-making.

What is the China Coastal Bulk Freight Index?

Tracks freight rates for coal, iron ore, grain, and steel along China’s coastal routes.

Measures short- and medium-haul shipping within China, unlike global freight indices.

Acts as a barometer for logistics trends, port activity, and transportation demand in China’s supply chain.

Reflects both immediate and long-term pricing.

Provides official and standardized data.

How is the China Coastal Bulk Freight Index Calculated?

The CCBFI calculation involves multiple variables, including shipping volume, distance, vessel type, and cargo category. The Shanghai Shipping Exchange collects real transaction data from carriers and shippers, then standardizes it for weekly updates.

Factors influencing calculation include:

1.Cargo type:

Heavier commodities like coal and ore usually have lower rates per ton than agricultural goods.

2.Distance:

Longer voyages generally cost more but may have lower per-ton costs.

3.Seasonality:

Weather disruptions and demand spikes (such as during winter coal demand) can raise rates.

4.Fuel costs:

Changes in bunker fuel prices affect operating costs.

What Factors Influence Freight Rate Fluctuations?

Several macro and microeconomic factors cause changes in the CCBFI:

- Economic growth: Strong demand for raw materials pushes freight rates up.

- Government policies: Regulations on fuel use or emission controls can increase shipping costs.

- Weather: Typhoons or seasonal fog in eastern China can disrupt schedules.

- Port congestion: High cargo volumes may lead to delays and higher rates.

Table: Key Factors Impacting Coastal Freight Rates

| Factor | Impact on Freight Costs | Example Scenario |

|---|---|---|

| Economic Growth | Increases demand, higher rates | Surge in steel demand from construction |

| Fuel Prices | Raises operating costs | Rising bunker fuel prices |

| Seasonal Demand | Rate volatility | Winter coal shipments |

| Weather Conditions | Delays and surcharges | Typhoon season in southern ports |

How Does the Index Compare to Other Freight Benchmarks?

Unlike the Baltic Dry Index (BDI), which tracks global shipping rates for dry bulk cargo, the CCBFI focuses on China’s domestic routes. It complements the China Containerized Freight Index (CCFI), which measures international container rates.

The CCBFI is more relevant for businesses moving raw materials domestically, while BDI and CCFI matter more for international traders.

Table: Comparison of Freight Indices

| Index | Scope | Cargo Type | Geographic Focus |

|---|---|---|---|

| CCBFI | Coastal | Bulk (coal, ore, grain) | China domestic |

| CCFI | International | Containerized cargo | Global |

| BDI | International | Dry bulk | Global |

Can the Index Help with Cost Forecasting?

Yes. The CCBFI provides insight into shipping cost trends, which helps companies forecast expenses. For example, a cement manufacturer shipping raw materials from northern ports to southern provinces can use the index to budget transportation costs in advance.

Moreover, freight forwarders and logistics managers can adjust routing or scheduling strategies depending on the index movement. For instance, when freight rates rise, businesses may stockpile commodities before peak season.

What Are the Advantages and Limitations of Coastal Shipping?

Advantages:

- Cost-effective for heavy, bulk goods

- Reliable for domestic distribution

- Large cargo capacity per vessel

Limitations:

- Susceptible to weather delays

- Slower than rail or road for short distances

- Dependent on port infrastructure availability

Table: Pros and Cons of Coastal Shipping

| Aspect | Advantages | Limitations |

|---|---|---|

| Cost | Lower per-ton shipping cost | Fuel surcharges impact |

| Capacity | Handles bulk shipments | Limited flexibility |

| Reliability | Stable domestic routes | Weather disruptions |

Case Study: Coal Transport Along China’s Coast

A major energy company regularly ships coal from northern ports (Qinhuangdao) to southern regions (Guangdong). By monitoring the China Coastal Bulk Freight Index, the company adjusted its procurement strategy:

- Before peak season: Stockpiled coal when index levels were low.

- During winter: Scheduled early shipments to avoid price spikes.

- Outcome: Reduced transportation costs by 8% annually and improved delivery reliability.

This example illustrates how businesses can apply index insights to real-world supply chain planning.

How Do Seasonal Trends Affect the Index?

Seasonal changes play a major role.

For instance:

- Winter: Coal demand surges, pushing up rates.

- Summer: Typhoons disrupt southern coastal routes.

- Harvest season: Agricultural bulk cargo drives temporary demand increases.

These patterns make it essential for shippers to analyze the CCBFI regularly, especially when planning contracts or scheduling deliveries.

What Documents Are Required for Coastal Bulk Shipping?

Although domestic shipping is less complex than international trade, certain documents are necessary.

Table: Common Documents for Coastal Bulk Freight

| Document | Purpose | Issued By |

|---|---|---|

| Bill of Lading | Proof of shipment | Carrier |

| Cargo Manifest | Cargo details | Shipper |

| Port Clearance | Entry/exit approval | Port Authority |

| Insurance Certificate | Coverage for cargo | Insurance provider |

Conclusion

The China Coastal Bulk Freight Index is a powerful tool for businesses moving bulk commodities along China’s coastline. It not only reflects shipping cost trends but also provides guidance for budget planning, contract negotiations, and risk management. By understanding seasonal fluctuations and market drivers, companies can optimize logistics strategies, reduce costs, and improve supply chain efficiency.

Need a Shipping Quote?

If you want expert guidance and peace of mind, our team is ready to assist.

TJ China Freight offers tailored solutions to help businesses of all sizes ship more reliably from China.

FAQ

Q1:What is the difference between CCBFI and CCFI?

The CCBFI tracks coastal bulk freight rates for domestic trade in China, while the CCFI monitors international container shipping rates.

Q2:How often is the China Coastal Bulk Freight Index updated?

The Shanghai Shipping Exchange updates the index weekly to reflect the latest freight rate changes.

Q3:Can small businesses use the CCBFI?

Yes. Even smaller manufacturers benefit from monitoring the index to forecast costs and negotiate with carriers.

Q4:Which industries rely most on the index?

Energy, construction, agriculture, and manufacturing companies use the index heavily due to their dependence on bulk commodities.

Q5:Does weather impact the China Coastal Bulk Freight Index?

Yes. Typhoons, heavy rain, and fog can disrupt shipping schedules, leading to temporary spikes in freight rates.